Aug 11, 2023

Updated to v1.52

Download the cQ-Baseline v1.5 Indicators for MT4

For the cQ-Baseline with Buttons go here.

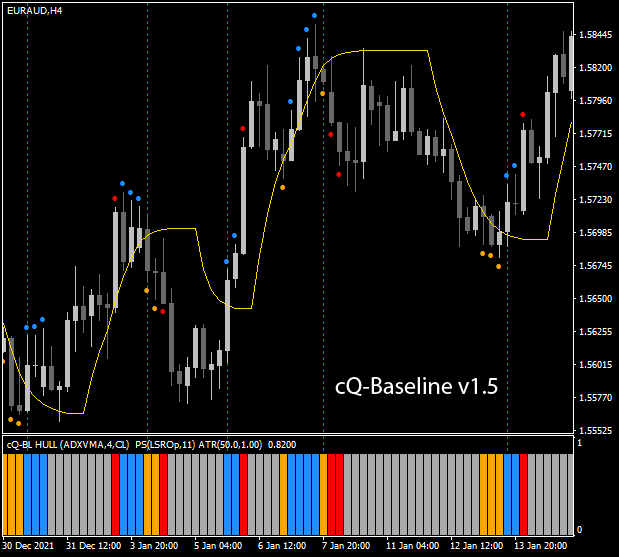

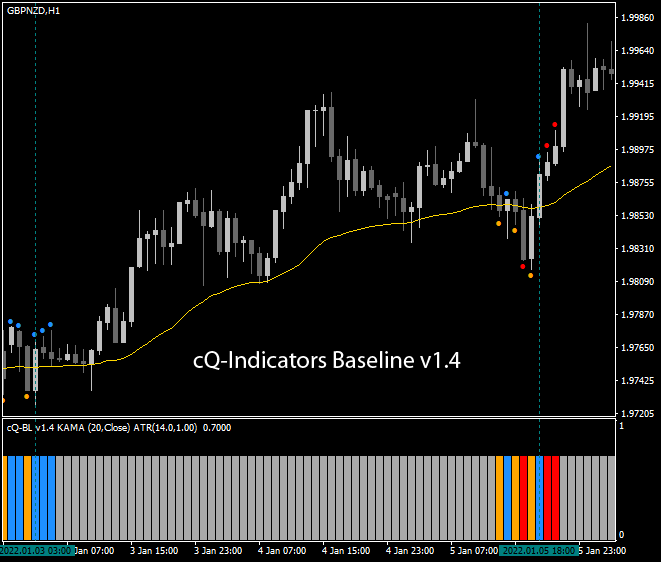

The cQ-Baseline are used to find possible entry points. These indicators are designed to be used with the No Nonsense Forex way of trading. When price crosses the baseline (a moving average) then either a blue, orange, or red dot will be drawn. If blue then look for a possible BUY. If orange look for a possible SELL. If red then no trade as price has gone past the baseline greater than 1 x the current ATR.

These Baseline indicators are now the indicators found in the cQ-Baseline Trend Direction StdDev Inverted Indicators. At some point in the future there will be a matching Baseline indicator with the Baseline Trend Direction StdDev Invert indicators.

Currently there are 16 moving average types (a separate *.ex4 file for each). Also in the zip file you'll find a matching baseline histogram version. This will allow you to remove the baseline from the main chart and give you more room for other indicators on the main chart.

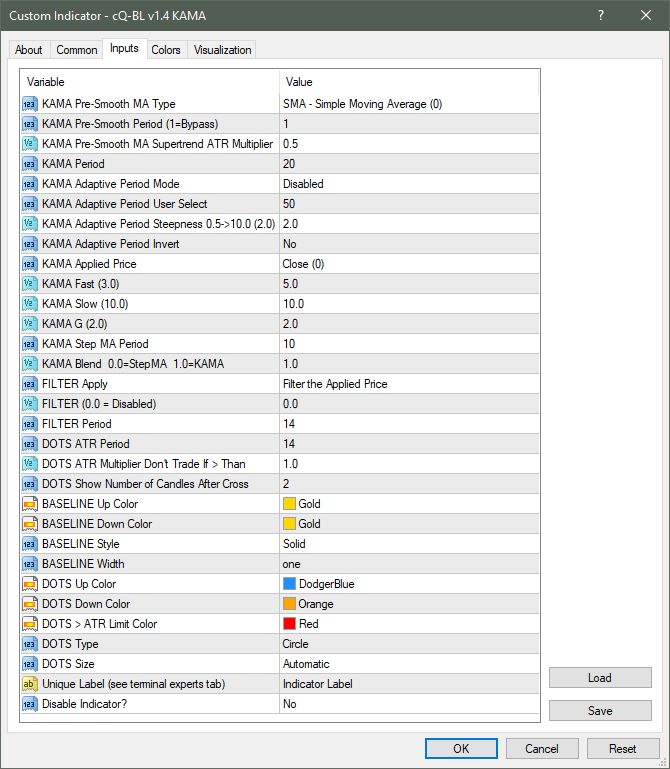

The flowchart of most of the cQ-Baseline v1.4 indicators is:

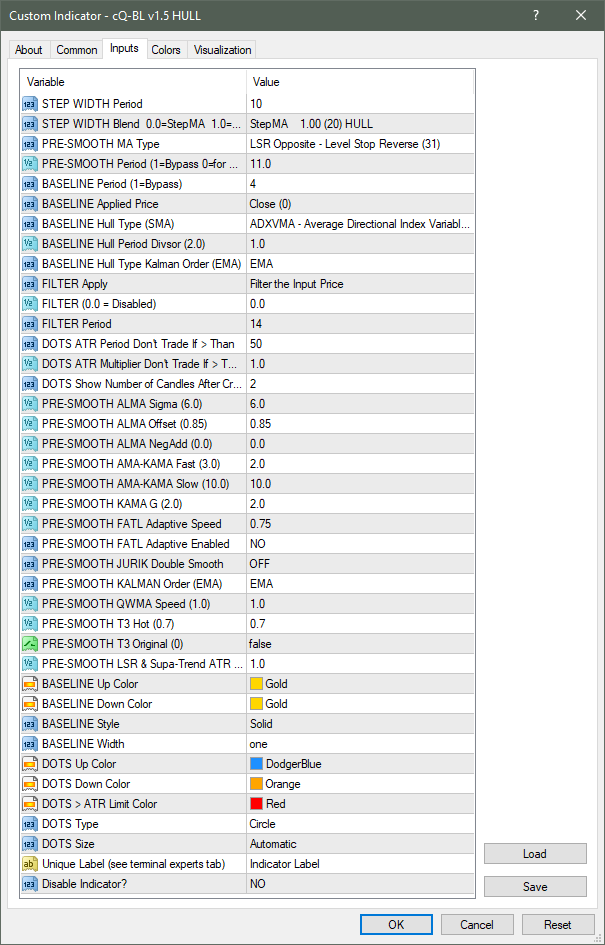

Pre-Smooth -> Adaptive-Period -> Baseline-Moving-Average -> Step-Width -> Percent Filter

The Pre-Smooth moving average that can be used to further modify baseline's output. Currently there are 25 Pre-Smooth moving average types, include Half-Trend, Level-Stop-Reverse, and Super-Trend. Each indicator has an Adaptive Period that will shorten the period as the ATR increases so that the moving average 'adapts' to the price action. The Step-Width can be used to reposition the baseline moving it to a more appropriate area on the chart. Using a higher value (above 50) can create an instant longer term baseline. The Percent Filter can be used to in the similar way as the Step-Width.

As for drawing the dots you can select the ATR period and multiplier if you need to change it to match your algorithm. 1.0 is the default meaning 1xATR. There is also a parameter that lets you display 'X' number of dots after the initial baseline cross. This can be helpful when waiting for your confirmation indicators to catch up.

Baselines currently included:

- ADXVMA

- ALMA

- AMA

- DEMA

- Deviaition Scaled MA

- Elders Optimum Tracking Filter

- HULL

- JURIK

- KALMAN NONLINEAR

- KAMA

- QWMA

- SMA, EMA, SMMA, & LWMA

- Step RSI Adaptive

- T3

- TMA

- VIDYA CMO

Updated the AMA and KAMA indicators to v1.51:

I switched the Adaptive Period to work on the Fast & Slow parameters instead. The Baseline Period doesn't effect the indicators as much as having adapative Fast & Slow parameters.

Updated all indicators to v1.52, fixed a number of things.

July 21, 2023

Download the cQ-Baseline v1.4 Indicators for MT4

For the cQ-Baseline with Buttons go here.

The cQ-Baseline v1.4 are the same ones found in the cQ-BTD StdDev Invert indicator. The v1.5 version above will replace this version as the baseline indicators used for all cQ-BTD StdDev Invert indicators and those that are upcoming.

Currently there are 16 moving average types (a separate *.ex4 file for each). Also in the zip file you'll find a matching baseline histogram version. This will allow you to remove the baseline from the main chart and give you more room for other indicators on the main chart.

The flowchart of most of the cQ-Baseline v1.4 indicators is:

Pre-Smooth -> Adaptive-Period -> Baseline-Moving-Average -> Step-Width -> Percent Filter

The Pre-Smooth moving average that can be used to further modify baseline's output. Currently there are 25 Pre-Smooth moving average types, include Half-Trend, Level-Stop-Reverse, and Super-Trend. Each indicator has an Adaptive Period that will shorten the period as the ATR increases so that the moving average 'adapts' to the price action. The Step-Width can be used to reposition the baseline moving it to a more appropriate area on the chart. Using a higher value (above 50) can create an instant longer term baseline. The Percent Filter can be used to in the similar way as the Step-Width.

As for drawing the dots you can select the ATR period and multiplier if you need to change it to match your algorithm. 1.0 is the default meaning 1xATR. There is also a parameter that lets you display 'X' number of dots after the initial baseline cross. This can be helpful when waiting for your confirmation indicators to catch up.

Baselines currently included:

- ADXVMA

- ALMA

- AMA

- DEMA

- Deviaition Scaled MA

- Elders Optimum Tracking Filter

- HULL

- JURIK

- KALMAN NONLINEAR

- KAMA

- QWMA

- SMA, EMA, SMMA, & LWMA

- Step RSI Adaptive

- T3

- TMA

- VIDYA CMO