Requirements

MT4 - MetaTrader 4

Version 4.00 Build 1360 or greater

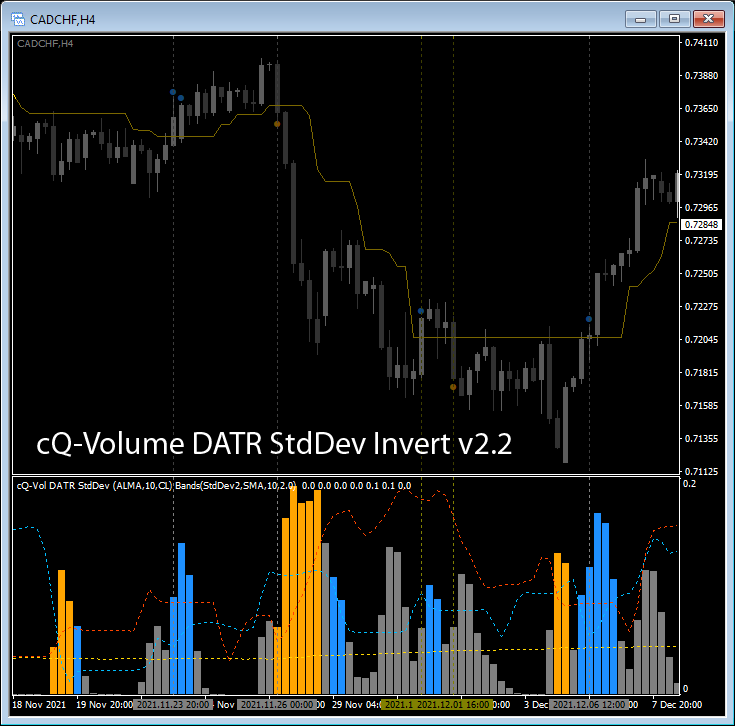

August 26, 2023 - Updated to v2.2 (must have placed wrong file in the zip, moving averages updated to v1.3)

Download cQ-Volume DATR StdDev Invert v2.2 Indicator for MT4

Watch the video below to view the updates. The zip file also contains 6 presets with baselines to help you get started.

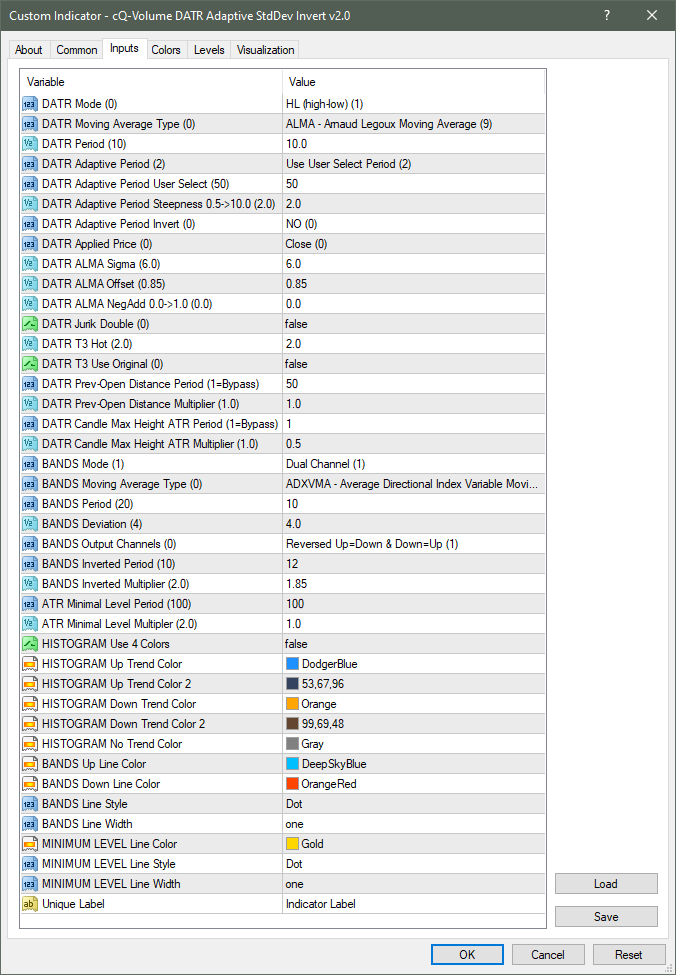

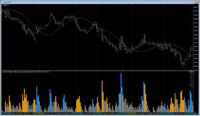

The cQ-Volume DATR StdDev Invert indicator is mainly used as a volume indicator but can be used as a confirmation indicator. If there is enough Buy volume then a blue bar is drawn, while if there is enough Sell volume then an orange bar is drawn. A gray bar is drawn if there isn't enough up or down volume.

|

|

|

|

|

|

The indicator is similar in design to the W.A.E. volume indictor but does not use the MACD. In place of the MACD the DATR is used, that is the Directional Average True Range. If the candle's close is greater than it's open then it is used for the Buy ATR, and if the close is less than the open it's used for the Sell ATR. The price data is then input in to a moving average which outputs the DATR. If the Up DATR is greater than the Down DATR, then the Up DATR is used and vice-versa.

This indicator is the first one that has been simplified which hopefully will make it easier to understand and use. There will be another 3 indicators similar in operation to this one but will use the ATR/Inverted StdDev, Moving Average/Inverted StdDev, and the more familar non-inverting StdDev and Moving Average (signal) in place of the StdDev/Invert StdDev indicator.

The basic idea of this indicator is there are two StdDev parameters. The first StdDev parameter operates as you would expect and is shown as BANDS Deviation, while the second one is subtracted from the first and is shown in the indicator dialogbox as BANDS Invert Channels. This gives the indicator a somewhat fast response. The DATR furthers this response by quickly dropping below the enough volume level when price goes sideways.

In version 2.0 I added five DATR input modes which can significantly change the way the indicator responds. The five modes are:

- C2C - close[0]-close[1]

- HL - the high-low

- HL2 - the high-low as well

- HLOC - high-low ± close-open depending on direction.

- H2HL2L - UP(high[0]-high[1]+low[0]-low[1]) DOWN(high[1]-high[0]+low[1]-low[0])

- OC/CO - UP(close-open) DOWN(open-close)

To each of the DATR input modes I've added two parameters based on the ATR. The first is the DATR Previous-Candle Distance. To see an example of what it does watch the above video. Briefly it helps reduce the level of noise and at higher level 1*ATR and above it removes many of the false signals (at the cost of also removing some good entries). On how it works, for example when using the C2C mode with the trend going in the UP direction, the current close has to be above the previous open by the DATR Previous-Candle Distance ATR amount in order for the close[0]-close[1] (C2C) to be placed the the UpBuf[0].

This version includes a Adaptive mode based on the ATR. In this mode the indicator period becomes shorter as the ATR increases. It can be applied to a number of moving averages and has a User Select Period. The adaptive portion can also be disabled. You can also try the Adaptive Period Steepness parameter for changing the adaptive properites (make it faster or slower).

There are only two BAND modes: Single and Dual Channel and the other parameters function don't change if you change modes. In Single Channel mode both the Up and Down are used to generate the trigger linesthey are summed together and divide by two.

The Minimum Level can be used to help reduce the noise when price is going sideways. The histogram will turn gray when current level is inside this area.

May 16, 2023 - I removed Limiter Level parameter and added two new parameters. I also added a few. When enabled this parameter causes the DATR levels to becomed flatten out. This increases the number of Buy/Sell triggers. See the Dialog Box image below.

NOTE: If you place a 0.0 in the BANDS Invert Channels Multiplier parameter the BANDS will act like a normal StdDev.