Requirements

MT4 - MetaTrader 4

Version 4.00 Build 1360 or greater

August 26,2023

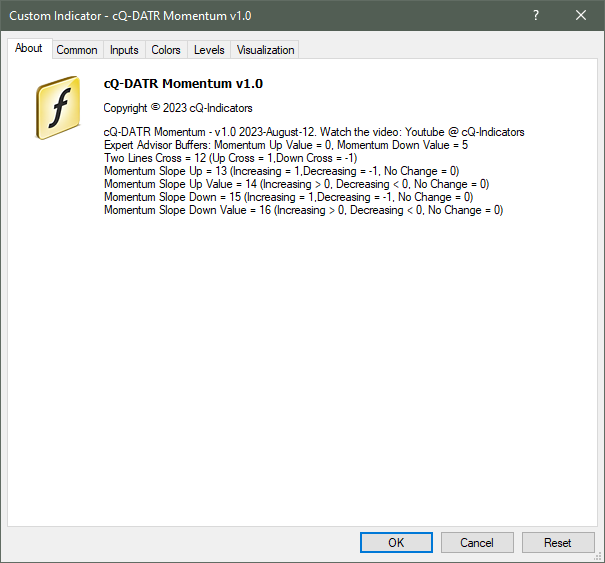

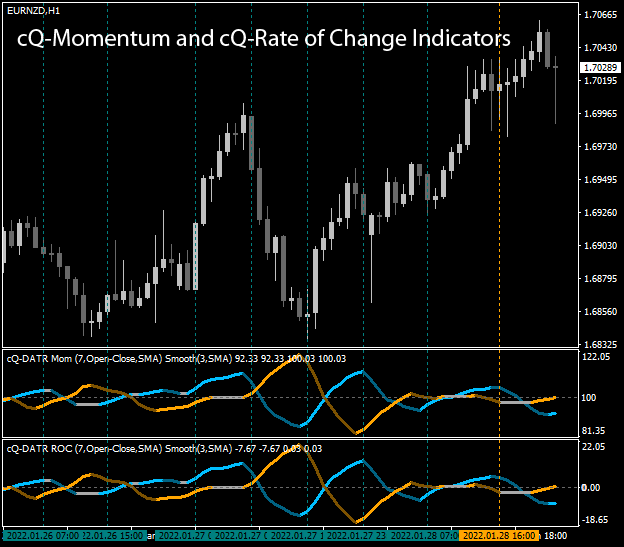

The cQ-DATR Momentum and cQ-DATR ROC indicators can be used as a confirmation or exit indicator. The Momentum is pretty much the same thing as the ROC. This version version uses the DATR (Directional-ATR) as an input producing two separate lines: one UP and the other DOWN.

August 28, 2023: Update v1.1

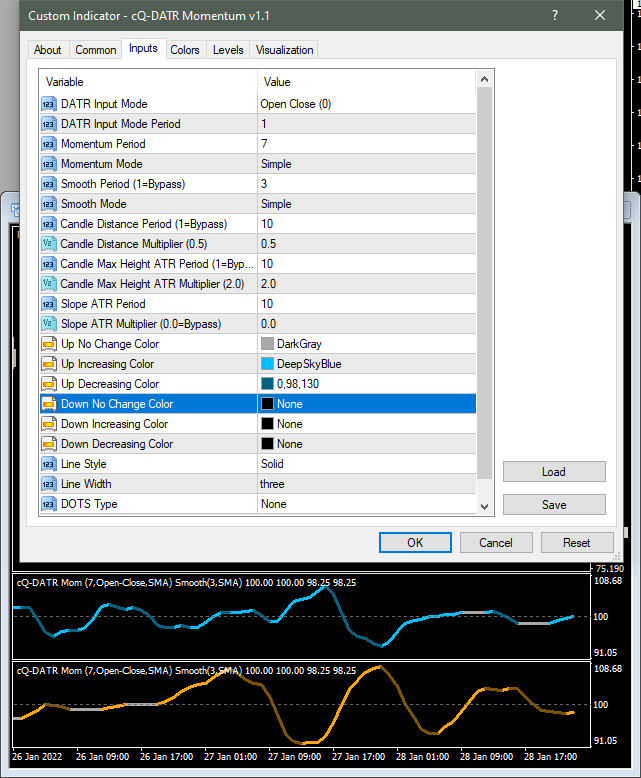

I added an Up No Trend Color and a Down No Trend Color so you can use two indicators on a chart. This will allow you to use the None color and hide one of the channels. Sometime the down momentum line blocks the up momentum line. This isn't necessary if you are using it as an expert advisor.

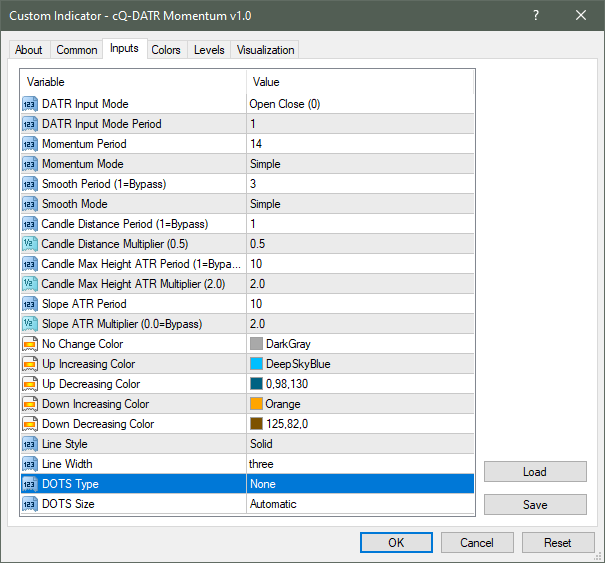

If the momentum is up and increasing then the indicator will draw a brighter blue color. If the momentum is up and decreasing then it will draw a darker blue color. If the momentum hasn't change then it will draw a gray color. The same thing for the down momentum line except the color will be a brighter orange color and a darker orange (brown) color.

The indicator has two DATR Input Modes: Open_Close and High_Low. If the current close of the candle is greater than the current open then the AbsolueValue(close-open) is put in the up buffer and a 0.0 value is put in the down buffer. If the current close is less than the current open then AbsoluteValue(close-open) is placed in the down buffer and the up buffer value is set to 0.0. The DATR Input Mode Period allows for a longer period to be used. This will average either the high-low or AbsoluteValue(close-open) over the period. For the high-low period is the same thing as using the ATR. The AbsoluteValue(close-open) is the ATR using the open and close in place of the high low.

The momentum can be calculated using the SMA, EMA, SMMA, or LWMA. It can futher be smoothed to make it easier to read (at the cost of latency) with the Smooth Period and Smooth Mode.

There are two input pre DATR functions and one DATR post function that to the DATR-OCHL calculation. The first is the Candle Distance (an ATR value). It is a distance added or subtracted from the previous open. If the close[i] > open[i+1]+CandleDistance then either the high-low or Abs(close-open) is placed in the Up Buffer. If the close[i] < open[i+1]-CandleDistance the either the high-low or Abs(close-open) is placed in the down buffer. Otherwise the up or down buffer is set to 0.0. This helps remove smaller sizeways price action from entering the DATR up or down buffers. The Candle Distance is the ATR controlled by the Candle Distance Period and the Candle Distance Multiplier.

The 2nd pre-DATR function is the Candle Max Height (also an ATR value) will limit the height of the candles to the ATR amount controlled by the Candle Max Height Period and Candle Max Height Multiplier. This will limit the affect really large candles have on the calculation.

After the DATR-OCHL are calculated the Slope ATR (an ATR value) is applied to both the up and down buffers. This function will increase the amount of slope, the distance from the current momentum value and the previous momentum value, required to change the color to either the Brighter Blue or Brighter Orange. Increasing the Slope ATR Multipler will change the more the Brighter colors to Gray, meaning momentum hasn't changed. This will delay the time of possilble trade entry. It doesn't change anything else.

Watch the video to get a better idea of what the indicator does.